Clean energy companies today do not struggle because they lack systems. They struggle because their systems do not talk to each other, and that gap is widening as operations scale.

As the sector matures, organizations now span origination, trading, asset generation, retail, and customer services. With every expansion comes added complexity, not only in what needs to be delivered but also in how systems, teams, and data must work together to make delivery seamless and scalable.

For example, Pexapark reports that in 2024, 85% of PPA contracts were signed by corporate buyers. At the same time, demand from data centers is rising sharply, and the growth of AI is driving electricity consumption even higher. As more corporations pursue ambitious sustainability targets, the range of companies entering clean energy agreements will only continue to expand.

Why Traditional Systems Break Under Modern Contracts

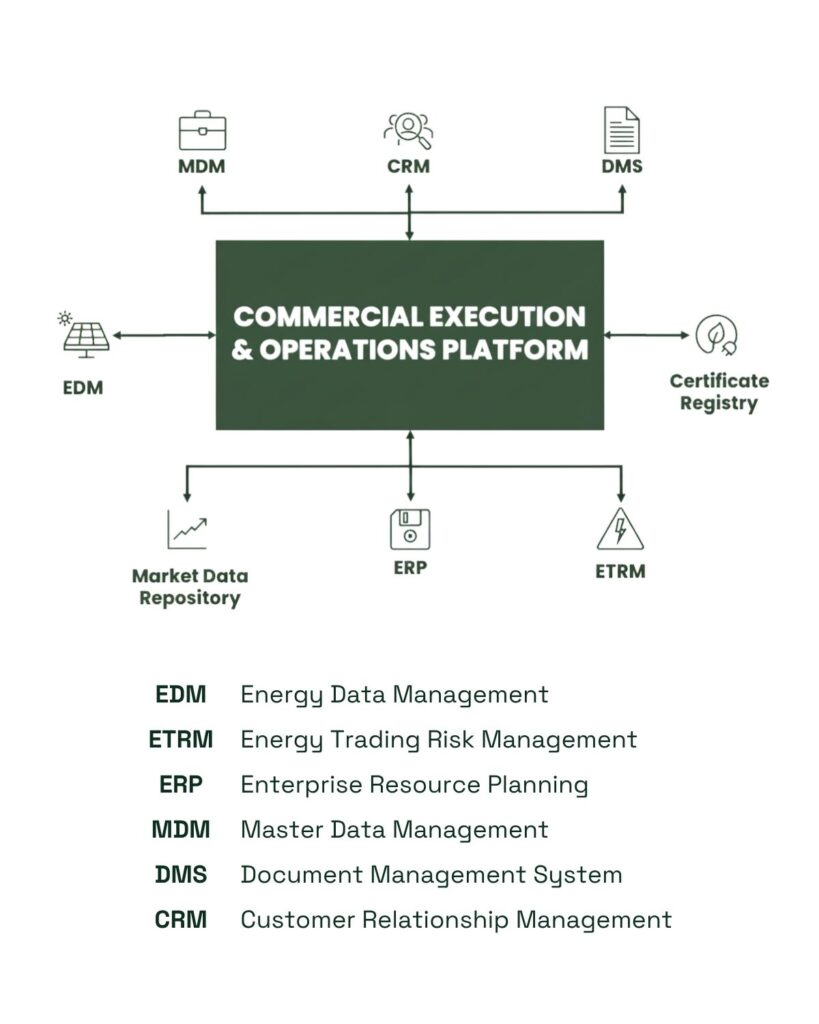

Most companies rely on the familiar trio: ETRM for trading positions, ERP for financials, and CRM for customer interactions. Each is powerful in isolation, but none can manage the full lifecycle of today’s clean energy contracts.

Modern agreements often involve location-based services, multiple delivery points, settlement terms tied to physical generation, and customized invoicing. These are not exceptions. They are the new standard in renewables and distributed energy.

The result is a patchwork of spreadsheets, scripts, and fixes buried inside system configurations. Over time, this creates an architecture that is fragile, difficult to audit, and prone to errors.

Even in regions like the European Union, where harmonization might be expected, differences in tariffs, file formats, balancing rules, and tax regimes make one-size-fits-all solutions impossible. Companies often build hyperlocal tools that work in one market but cannot be reused elsewhere.

In my experience, companies often underestimate country-specific differences and the hidden cost of maintaining endless workarounds and customizations. These fragmented setups not only drive up operating expenses but also increase the risk of costly errors and reputational damage. Because the landscape is naturally fragmented, few organizations recognize the full picture or the significant synergies that can still be captured across markets.

Platforms for Digital Contract Modelling and Commercial Execution

The next step in clean energy operations is to adopt a platform that can digitally model origination and clean energy contracts and orchestrate the end-to-end commercial process.

Such a platform captures the structure of an agreement starting with the physical delivery points and the services supplied to those points. It allows the contractual terms and financial calculations to be represented in a way that can drive workflows across trading, billing, and accounting. Instead of duplicating logic across ETRM, ERP, and CRM, the platform provides a semantic layer where operational impacts are interpreted, actions are triggered, and results are distributed in a structured and auditable manner.

This approach connects the physical world of energy delivery with the financial and operational layers of the business. A wide range of platforms can support this capability, from solutions designed to cover specific functions and orchestrate workflows to more advanced options that provide full analytical depth and AI-driven insights. The right choice depends on the organization’s maturity, integration needs, and long-term vision, and experienced implementation partners can help accelerate delivery and embed best practices.

From my own experience and work with clients, I have seen many companies already experimenting with elements of this concept, whether through spreadsheets, manual processes, or custom-built tools. These efforts often remain isolated and are rarely treated as a true commercial operations platform. At the core are the physical deliveries to specific points, and every other activity groups, executes, or calculates the financial and operational impact of those deliveries. The organizations that succeed are those that select and integrate a platform capable of enabling this digital modeling and orchestration across their existing systems, achieving a level of control and scalability that piecemeal approaches cannot match.

Data as the New Contract Language

Without good data, even the best-designed systems fail. But good data is more than accuracy. It must reflect how the business actually works.

For energy companies, this means describing contracts, assets, delivery points, and prices in a way that every system can understand and use. A digital contract model helps, but only if it is supported by a strong data foundation:

- A well-managed set of master data, including sites, assets, contracts, and counterparties

- Clear rules and ownership for keeping data consistent across systems

- A central integration layer that connects ETRM, ERP, CRM, EDM, and execution platforms

- Monitoring and change tracking to keep data flowing smoothly

Data must be understood across teams, connected across systems, and flexible enough to handle local differences such as delivery point hierarchies or jurisdictional VAT rules. Without this, efforts toward automation or scalability will stall.

One of the most surprising patterns I have observed across companies is how difficult it is to reconcile key figures such as realized P&L, invoiced amounts, ERP values, and actual cash received. The liquidity crunch during the 2022 energy crisis, when exchange prices and collateral requirements increased sharply, exposed this weakness and forced continuous monitoring of margin calls, credit exposure, and settlement flows. It became clear that understanding how each trade or contract affects both P&L and liquidity is far from trivial. Achieving this level of control requires all the components mentioned above, including a strong data foundation, consistent master data, clear ownership, and an integrated execution platform, so that operational and financial flows can be connected and orchestrated from front to back.

Scaling Clean Energy Starts With People

Technology and data alone cannot solve the integration challenge. Success depends on an organizational design that balances global consistency with local adaptability.

Over-centralization slows decision-making and strips away local insight. Full decentralization creates duplication, inefficiency, and governance challenges. The most effective model is distributed execution with centralized guidance.

Local teams manage what they know best: tax rules, regulatory changes, customer relationships, and local context.

Central teams provide the backbone: shared platforms, common data models, and governance.

Clean energy may be traded on wholesale markets that are relatively standardized, but distribution and meter-level operations remain highly local. I have seen many companies underestimate this when moving from regional PPAs or retail activities to a Europe-wide footprint. Practices that work in one country rarely transfer without adaptation, and the cost of overlooking local settlement rules, metering hierarchies, or regulatory nuances can be significant. Recognizing these differences early and designing for them is essential for any organization seeking to scale across borders. Clean energy is global but governed locally. Recognizing this is key.

Critically, organizations must be honest about capacity. Even the best design falters if teams are overstretched or missing capabilities. Strategic reinforcement, whether for a short phase or a critical function, can keep progress on track and free internal teams to focus where they add the most value.

The Way Forward: Commercial Data and Operations as Living Digital Assets

Clean energy companies are entering a phase where flexibility, integration, and scalability define the competitive edge. Success no longer depends on whether an organization has ETRM, ERP, or CRM systems. It depends on how well these systems and the data they hold are orchestrated across the entire lifecycle of commercial operations such as lead generation, nominations, forecasting, invoicing, and settlement.

The companies that thrive will be those that treat their core commercial data and related entities such as contracts, delivery points, assets, and counterparties as living digital assets that connect people, processes, and platforms. This requires a strong data foundation, modular execution layers, and empowered teams working in harmony.

No organization begins this journey fully prepared. Legacy systems, limited capacity, and multi-country complexity are common. But with the right support and a clear design, companies can scale with confidence.

When business, technology, people, and data move together, growth stops being about fighting complexity and becomes the path to a clean energy future that is consistent, auditable, and ready for what comes next.

Looking for more insights?

Get exclusive insights from industry leaders, stay up-to-date with the latest news, and explore the cutting-edge tech shaping the sector by subscribing to our newsletter, Commodities Tech Insider.