While tech companies slash jobs and cut rates, commodity trading firms are investing heavily in their technologists—who earn up to 2-3x more than those in traditional tech roles. Why? Because trading firms need developers who can talk to traders, understand the business, and deliver production-quality code.

You can be the best developer in the world, but if you don’t understand why weather patterns affect prices or how pipeline constraints impact gas trading, you’ll struggle to design effective solutions. Most developers ignore this domain because they think it’s too complex—which creates a massive opportunity for those willing to learn.

Jordan Dimov has spent years building trading systems at firms like Shell, Centrica, and asset management businesses. In this article, he shares why being able to talk to traders and analysts in their own language is key to landing the top-paying tech roles.

Here’s how building your domain knowledge can benefit you:

- Opportunity: Energy markets are being transformed by renewables, short trading intervals, and algorithmic systems. Firms need engineers who can build next-generation platforms. The skills gap is massive.

- Job Security: Unlike traditional tech jobs, which are increasingly vulnerable to AI and outsourcing, trading technology requires deep expertise that can’t be easily replaced.

- Compensation: While regular dev salaries stagnate, in trading you can earn up to £800-1000/day for contract or £150-275k base for permanent roles. You’re not just writing code—you’re directly impacting revenue generation.

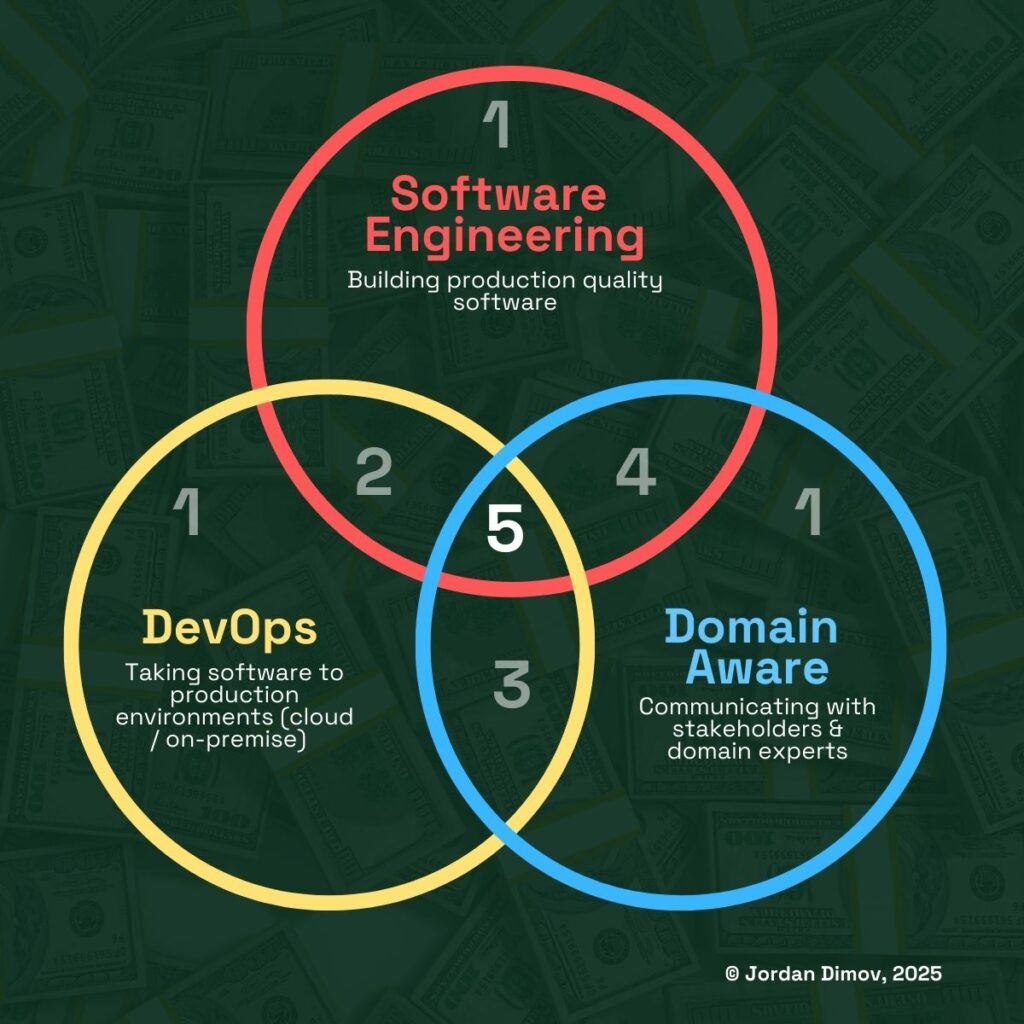

Which level are you? Developers who unite strong software engineering skills, DevOps expertise, and domain understanding become invaluable. If you’re at level 1 – regardless of which circle – you are at risk. When you’re at level 5, it’s a very good place to be.

Why domain knowledge matters:

To fully grasp the importance of domain knowledge, you must understand the complexities of commodities markets.

Take the energy industry for example. The market is being transformed by renewables, and it’s shifting from daily trades to 10-minute intervals. In the UK and European energy markets, electricity and gas prices can swing wildly in minutes. Wind farms suddenly stop generating on a calm day, a gas pipeline hits capacity limits, or French nuclear plants go offline for maintenance—and prices react instantly.

Each country has its own energy mix and infrastructure constraints, which is why the same megawatt-hour of power might cost £50 in Norway but £200 in the UK at the exact same moment. This creates arbitrage opportunities (i.e. the ability to profit from these price differences by buying on one market and selling on another, within the physical constraints of the relevant infrastructure.)

Unlike the stock market, energy markets are more directly tied to physical realities: electricity can’t yet be stored on a large scale, gas flows are constrained by the networks of pipelines, and a single geopolitical event can send prices skyrocketing across the continent. Building systems that can handle these realities while processing real-time data and managing risk—that’s where the real value is. And that’s why the demand for developers who understand both the technical and business sides has never been higher.

Firms need developers who understand:

- How commodities markets work

- The specific challenges facing trading

- How to build reliable, real-time data pipelines

- The regulatory requirements and compliance needs

- How to work effectively with traders and analysts

Remember: The goal isn’t to become a trader – it’s to become the engineer that traders trust to build their tools.

What you need to do:

Get into the habit of asking why, not what. Don’t just build what traders ask for—try to understand the larger business context behind the request and then validate your understanding by playing back what you heard (in business terms, not technical ones.)

Be proactive about data quality issues and system performance. Sometimes traders will tell you when something’s slow or data looks wrong—but just as often, they’ll simply be frustrated without bringing up those concerns. Or, they won’t even notice some data quality issues and will end up making poor financial decisions because of that. As a technologist, you need to have some level of confidence in what you are building—as well as the quality of the data—ideally before these things impact trading. Comprehensive end-to-end testing and non-functional testing are incredibly important in this business.

Need some help?

For more insights, follow Jordan Dimov on LinkedIn.

Also, check out Jordan’s “Commodity Trading for Software Engineers” training. It’s a practical, project-based 3-month course designed specifically for software or data professionals who want to understand the unique challenges of building systems for commodity trading, with a particular focus on energy markets.

With a very hands-on approach to exploring areas like algorithmic trading, market data systems, and risk management platforms, you’ll gain the domain knowledge you need to make the transition to a more rewarding career. Message [email protected] to learn more about upcoming cohorts.

Looking for more insights?

Get exclusive insights from industry leaders, stay up-to-date with the latest news, and explore the cutting-edge tech shaping the sector by subscribing to our newsletter, Commodities Tech Insider.