When it comes to trading, everyone’s chasing Alpha – their competitive edge. But this quest has led people to some truly crazy places. From deep underground to the far reaches of space, trading firms will go to wild lengths to secure returns. Read on as we explore some of the most outlandish and downright bonkers projects ever undertaken in the relentless pursuit of… Alpha.

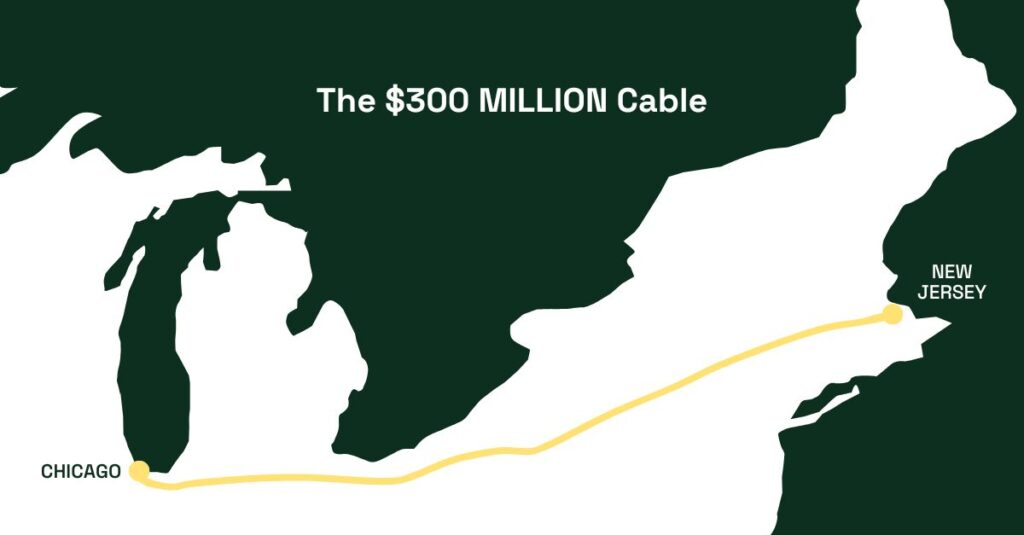

When is 4 milliseconds worth $300 million?

In the high-stakes world of high-frequency trading, time is money. Even a few milliseconds can mean the difference between securing the best price on a trade or missing out entirely. That’s why, in 2010, Spread Networks invested heavily in a bold infrastructure project: laying 1,331 kilometres of fibre-optic cable from Chicago to New Jersey. This $300 million project involved cutting through mountains and private land to create the most direct route possible, reducing transmission time for data from 17 milliseconds to just 13.

But the race for speed didn’t stop there. Trading firms have also invested in microwave technology. Unlike fibre optics, which transmit data through cables, microwaves send signals through the air, which can be faster over shorter distances.

Why did we fall out of love with pigeons?

While many people today might think of pigeons as little more than ‘flying rats,’ they once played a crucial role as messengers. Back in the 19th century, Paul Reuter (yes, the founder of Reuters) used homing pigeons to send stock prices between Brussels and Aachen, Germany. This clever move meant he could get market updates faster than anyone else, giving him an edge over his competitors.

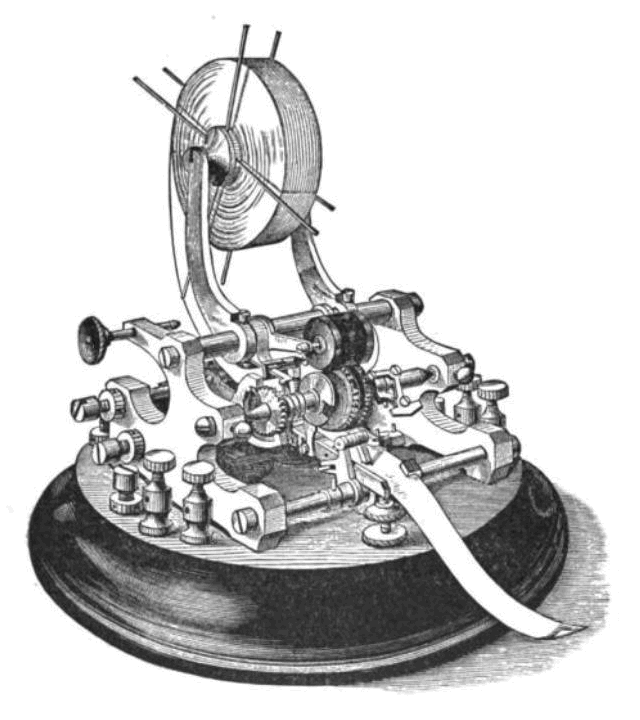

Edison’s Stock Ticker

If you ask a trader, they might argue that Thomas Edison’s greatest work wasn’t the light bulb – though that was impressive – but rather his improvements to the Universal Stock Ticker, originally invented by Edward Calahan. This ingenious device was a telegraph receiver that printed an alphabetical company symbol alongside the current price of that company’s stock. For the first time, stock prices could be updated in near real-time, allowing for faster and more precise trades compared to the old, slow hand-delivered messages, or even messages sent by pigeons. By the 1880s, around a thousand of these tickers were operating in New York’s financial district.

And today, the pursuit of Alpha continues, with data becoming a hot commodity.

Commodities trading firms are ramping up their investments in alternative data sources such as:

- Satellite imagery: Used to track crop health, monitor livestock, assess storage levels, and observe tanker locations – in a bid to better understand supply chain dynamics.

- Social media sentiment analysis: Analysis of posts and conversations on platforms like Twitter and Reddit to gauge market sentiment, public opinion, and to detect signs of political unrest or strikes that might affect commodity markets.

- Weather data and forecasts: Includes real-time and predictive weather data to anticipate impacts on agricultural yields, energy consumption, and transportation routes.

In today’s world, data, algorithms, and statistics are the closest thing traders have to a crystal ball. Once, having exclusive access to data – like renting a satellite to monitor crop health – was the key to gaining an edge. But, with data now being more widely accessible, the real advantage lies in how you use and interpret that information. It’s no longer just about having the data but about making the most of it. That’s why investing in skilled data and tech teams has become crucial.

Looking for more insights?

Get exclusive insights from industry leaders, stay up-to-date with the latest news, and explore the cutting-edge tech shaping the sector by subscribing to our newsletter, Commodities Tech Insider.